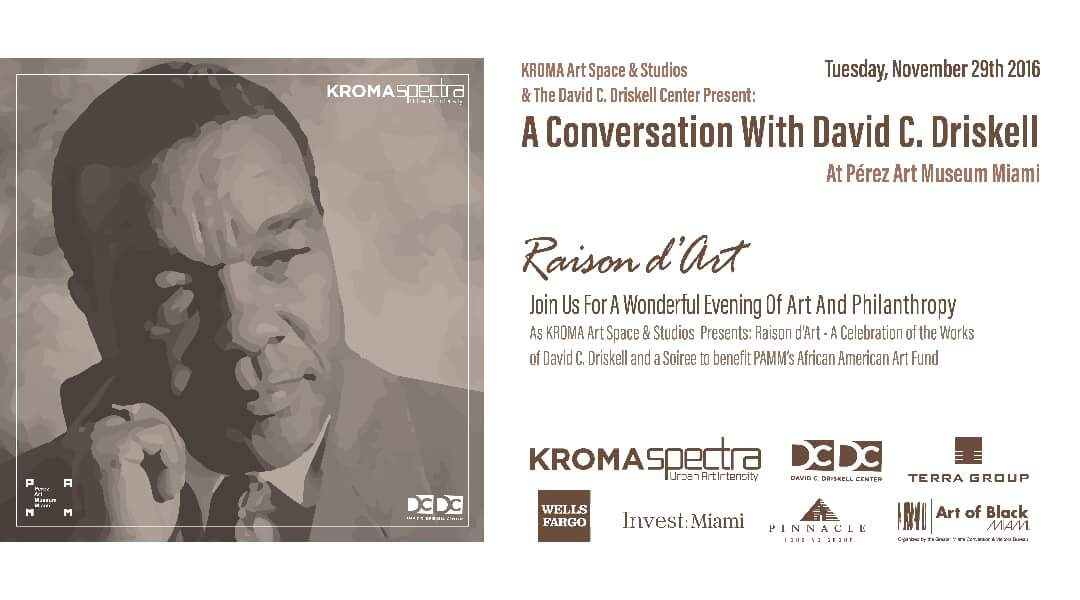

KROMA spectra media

KROMA SPECTRA — A CONVERSATION WITH DAVID C. DRISKELL AND RECEPTION

Invest: Miami speaks to Sherwood Neiss, Partner, Crowdfund Capital Advisors

Business partners Jason Best, Sherwood Neiss and Zak Cassady-Dorion knew they were against the odds when lawyers told them it was impossible to change a law.

In 2010, the three entrepreneurs had realized that the law didn’t allow small and medium-sized businesses to raise capital through crowdfunding as a result of an outdated system set in place by the Securities Act of 1933 and other laws. These laws did not allow entrepreneurs to raise money from friends and family who were not rich nor did they allow entrepreneurs to use the Internet, social media or any form of technology that we use today to help facilitate fund raising.

But, as Best recounted during a 2013 TED talk, he and his partners didn’t listen to the naysayers: “Entrepreneurs are naive. Entrepreneurs do things that are supposed to be impossible. They do things they’re not supposed to do.”

The trio set out to make the impossible become possible and change the system. Eventually, their ideas for a new framework that accommodated the nation’s modern, web-based entrepreneurial landscape eventually became the JOBS Act (Jumpstart Our Business Startups), which was signed into law by President Barack Obama.

Today, Best and Neiss are the principals of Crowdfund Capital Advisors, which are partners with the State Department’s Global Entrepreneurship Program and The World Bank. The company advises organizations on how to use crowdfunding to create an environment where jobs creation and entrepreneurship flourishes. They travel the globe reaching governments, multilateral organizations and regulators in more than 40 countries to make crowdfund investment work for them. Many are familiar with the basics of crowdfunding due to the success of websites such as Kickstarter, but Best and Neiss elevate investors’ knowledge, informing them of the new types of crowdfunding as well as the law’s recently passed titles.

Invest: Miami sat down with Neiss to discuss the titles of the JOBS Act as well as Miami’s crowdfunding potential.

INVEST: MIAMI: Tell us about the differences between the three crowdfunding JOBS Act titles.

SHERWOOD NEISS: When the JOBS Act passed in 2012, it introduced online fundraising for entrepreneurs and online investing for retail investors. First was, Title II that allowed businesses to raise capital online from accredited investors. Subsequent to that, Title IV went live that allows businesses to go to both accredited and nonaccredited investors for capital and can raise up to $50 million online. And finally with Title III, startups are now able to raise up to $1 million on debt and equity crowdfunding platforms as long as they are registered with the Securities and Exchange Commission. This will allow retail investors and entrepreneurs to expand their horizons and invest in endeavors they want to support. It’s important for entrepreneurs to understand all the provisions to determine which is right for you and your business. For instance, Title IV is good for larger companies as the process is more complicated and there’s more documentation. Smaller business may fail on Title IV because it is too expensive and time consuming. Think of these 3 types of crowdfunding like different tools in a toolbox. Sometimes you need a hammer, sometimes a screwdriver and sometimes a wrench. Pick the right tool for your specific funding situation.

I:M: What does the data you are tracking show about what makes a successful campaign?

NEISS: Crowdfunomics is a new phenomenon today. It combines social media with finance. Crowdfund Capital Advisors (CCA) has developed a formula based on feedback from both successful and unsuccessful campaigns, giving us the ability to tell you exactly what makes a successful campaign or not. An important part of crowdfunding is, of course, the actual crowd. Social networks formed through real life and internet networking are the new sources of capital, and 80 percent of the capital raised is coming from these 1st and 2nd degree connections –it’s many small investments that make one big investment. Next is the communication that takes place between prospective investors and the company. This includes the video that sells the company’s vision, the team and the need and use of capital. It must be short, to the point, and compelling. Also entrepreneurs need to be interacting with prospective investors online during the fundraising process. If they fail to communication their chances of funding success diminishes. And finally is the structure under which you are raising capital. You need to match the corporate structure and the type of security to the needs of your investors. If you fail to get this right, then you will most likely not get funded. Corporate structures and security types need to be easily understood.

I:M: Tell us more about your partnership with Venture Hive. Do you have any other partnerships here in Miami?

NEISS: Now that the JOBS Act titles passed, education and training become the next most critical step. While experienced entrepreneurs, we are not experts in education, and so it becomes essential to partner with those entities that have educational expertise. Venture Hive, lead by Susan Amat, was the natural partner given their platform of turning our content into training models. Venture Hive’s programs are hands-on and interactive and give entrepreneurs the tools to understand the different crowdfunding platform available to them through the new JOBS Act titles.

I:M: Miami talks about being the next Silicon Valley, but it still has quite a way to go, especially on the investor side. How does crowdfunding help Miami achieve its goals?

NEISS: Miami has a lot of people with a lot of money who are looking for interesting investment opportunities, but it is true that the crowdfunding and startup ecosystem is still emerging. The opportunity is huge for Miami: Miami has the ability to be the U.S.’s next success story, and while eMerge brings us recognition, it should only be considered the tip of the iceberg: Miami needs strong actions from our political leaders, including training programs, conferences, events and media coverage as well as compelling incentives to start and keep your business here.

To learn more about Capitalfund Capital Advisors visit thier website: www.CrowdfundCapitalAdvisors.com

Over 300 people received the Invest: Miami 2016 book at Bisnow’s September conference in Miami.

BizNow’s 5th Annual Miami State of the Market, brought together Miami’s leaders across asset classes and industries, all whom have their hand in building the NEW Miami!

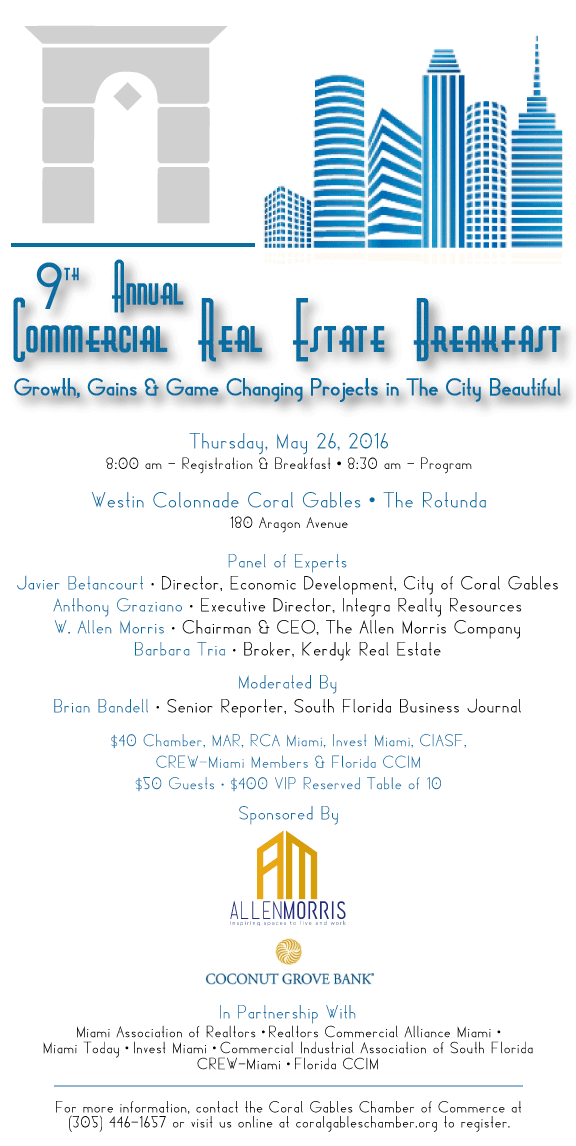

Capital Analytics assisted in moderating the Coral Gables Chamber of Commerce 2016 annual conference. The panel was part of the annual Coral Gables Chamber of Commerce conference. It featured representatives of sharing economy heavy hitters: Uber, Airbnb and Pipeline shared-working spaces.

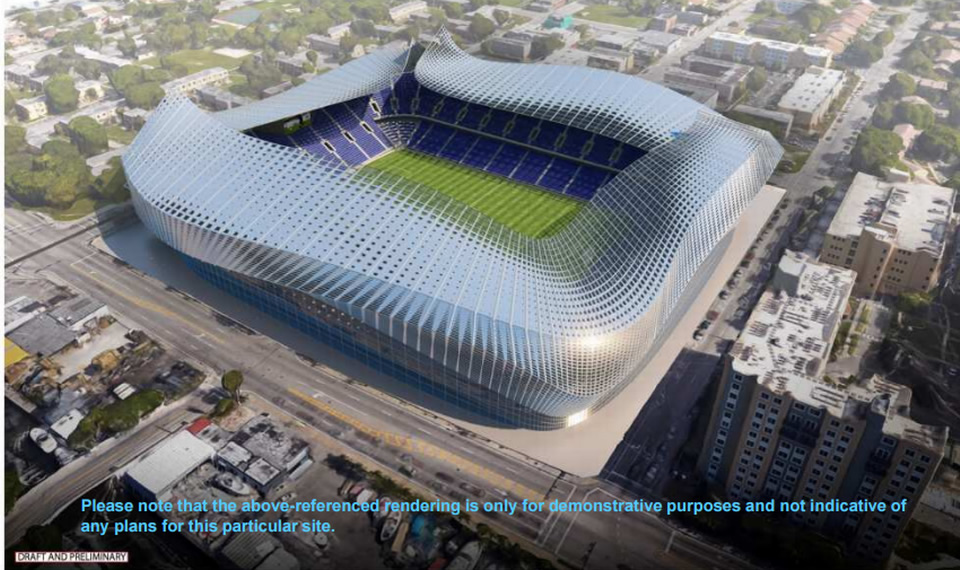

David Beckham and his investors have purchased the private land needed for a new stadium in Overtown, the organization announced Thursday, marking the first time the celebrity athlete has actually acquired Miami real estate for his Major League Soccer franchise.

The milestone gives the Beckham partnership ownership of about two-thirds of the nine-acre stadium site, according to the statement, and comes after more than two years of failed bids involving three other locations. The deals allow Beckham to now move fully into the political arena to win county approval for the purchase of government-owned land needed to complete the site for the stadium, and city approval of a zoning overhaul needed to build it.

“We have the right site, the right ownership group, and a loyal base of fans counting down the days until our first match,” Beckham partner Marcelo Claure, the CEO of Sprint, said in a statement. “We’re all-in on Overtown, and we couldn’t be more excited about moving forward with plans to deliver the most responsible stadium in Miami history.”

Miami Beckham United, the corporate entity Beckham owns with Claure, American Idol creator Simon Fuller, and others, has never made this much progress in its high-profile pursuit of a Miami stadium. Beckham wants a 25,000-seat home for the MLS expansion team he was given the option to purchase as a bonus for signing with the L.A. Galaxy soccer squad in 2007. Beckham’s option to purchase the franchise at a deep discount has been extended as his negotiators failed to land deals to build a stadium at PortMiami, next to the AmericanAirlines Arena in downtown Miami, and, most recently, across from Marlins Park in Little Havana.

The current site sits just north of the Miami River, in western Overtown and a short walk from the Spring Garden neighborhood. Bounded by Northwest Eighth Street to the north and Sixth Street to the south, the nine-acre property would be privately owned by the Beckham group, which began publicly chasing a Miami stadium in late 2013.

Beckham and partners are not asking for local subsidies to build or operate the stadium, and also say they plan to pay full property taxes for the land and venue. When the Marlins Park deal fell through in late 2015, Beckham declared Overtown his new top choice. The Dec. 4 announcement on Overtown included news that the partnership had, for the first time, signed sales contracts to purchase land for a stadium.

Actually buying the nine-acre property has taken longer than expected. Beckham and his ownership group hit delays in trying to close real estate deals for about six acres worth of privately-owned parcels surrounding an Overtown truck depot owned by the Miami-Dade Water and Sewer Department.

Join Miami Finance Forum for their CEO Power Breakfast Discussion!

The market for private transactions has evolved both overall and specifically in South Florida. There are alternative participants in the space that offer differing pros and cons versus a traditional PE fund buyer.

The discussion will be moderated by Stacia Wells, a partner at Bilzin Sumberg and speakers include Nathan Dapeer, principal, BBX Capital Partners, Casey Swercheck, vice president, CapitalSouth Growth Fund and Capitala Investment Advisors, Michael Tutner, managing director, Farlie Turner and Jamie Elias, partner, Trivest.

Bisnow is overly excited to announce their Evolution of Brickell & Downtown Miami, as over 100 projects in various stages reshape the area’s skyline.

Find out what developers, owners, investors, and government officials have to say about the area’s past, present, & future. What’s on the horizon for 2016? What does it take to make new projects stand out? How do we stay competitive in the city’s changing environment?

Come hear from their all-star panelists for the inside scoop on what to expect for Miami’s Downtown. As always, expect plenty of coffee & networking before and after their panel discussion.