Invest: Miami speaks with Richard Ballard, CEO

Miami is becoming an international cancer treatment destination, and the groundbreaking research, comprehensive diagnostics and discoveries of targeted treatments at Sylvester Comprehensive Cancer Center at the University of Miami are big reasons.

A Memorial Sloan Kettering study published in JAMA found Sylvester is one of 11 national cancer centers with the best patient outcomes, meaning our patients are more likely to survive than those at nearly any other hospital.

Sylvester is one of three Florida academic centers— the only one in South Florida—that Governor Rick Scott funded to achieve National Cancer Institute designation, allowing us to treat patients in more personalized ways with targeted therapy and treatment based on patients’ genetic makeup.

To offer these treatments, we invest in advanced technology. With radiation technology ViewRay— only five exist in the world—we deliver radiation in real time to avoid destroying healthy tissue and reduce side effects.

We also partner with centers researching therapies in clinical trials, including Memorial Sloan Kettering in New York, MD Anderson in Houston, and Dana-Farber in Boston. Our collaborations with South Florida and out-of-state medical centers will become important as the federal announcement of the National Immunotherapy Coalition supports cancer research.

Today, 36 percent of our patients come from Miami-Dade, while 47 percent come from Broward and Palm Beach counties and 8 percent are international, mostly from the Caribbean and Latin America. With a diverse population, we can conduct ethnic-specific research, advancing prevention and shaping diagnostics and treatments. Miami-Dade’s demographics, geographic position, growing population and improving economy are strong fundamentals for it to become a cancer research hub.

Invest: Miami speaks with Steven Sonenreich, President and CEO

With 5 million visitors coming to Miami Beach annually, the importance of Mount Sinai Medical Center and its strong emergency department cannot be overstated. Moreover, the economic impact that Mount Sinai has on its surrounding community is tremendous, falling somewhere between $5 billion and $6 billion a year. We are the only hospital in this city, and with 3,700 employees, we are also the largest employer in Miami Beach.

With 5 million visitors coming to Miami Beach annually, the importance of Mount Sinai Medical Center and its strong emergency department cannot be overstated. Moreover, the economic impact that Mount Sinai has on its surrounding community is tremendous, falling somewhere between $5 billion and $6 billion a year. We are the only hospital in this city, and with 3,700 employees, we are also the largest employer in Miami Beach.

We have a $250-million building program, which is allowing us to build a state-of-the art surgical tower with 154 private rooms and 12 operating rooms. As medicine moves more and more into the outpatient space, hospitals are evolving to become surgery centers with intensive care components. This building will further enhance our position as a surgical destination hospital.

Beyond surgical excellence, we are concerned about wellness. About five years ago we made the decision not to hire people who utilize tobacco products. To enforce this, we test our potential hires for tobacco use, in a manner that is legal and appropriate. For our existing population who smoke, we offer an assortment of smoking cessation programs and medication at the hospital’s expense. At the end of the day, we want people to take ownership and become responsible for their health.

If you were to ask what is the number one thing that keeps health care CEOs up at night, I would venture to say that 99 percent of them would answer Medicare and Medicaid reimbursement. Given that on average these funds make up 50 percent of the revenues of most hospitals, and an even greater percentage of revenues when it comes to long-term care, efficiency becomes the most important operational responsibility. Apart from reimbursement, one area where we still have a ways to go is transparency in the pricing of health care, medical devices and pharmaceuticals. Although we live in an age where we have access to all sorts of data and ratings, whether this is coming from U.S. News and World Report or The Leapfrog Group, there continues to be minimal knowledge when it comes to pricing.

Invest: Miami speaks with Jeffrey Freimark, President and CEO

When people think of Miami-Dade, they tend to focus on the glitz and the glamour. But this community, like much of the rest of the nation, faces significant challenges when it comes to elder care. Moreover, rising cost of care in this space is exacerbated by the fact that South Florida is an epicenter of Medicare fraud. While many institutions, like ours, operate according to the highest ethical standards, we are all affected by the prevalence of fraud. When the federal government does their audits, we are included.

When people think of Miami-Dade, they tend to focus on the glitz and the glamour. But this community, like much of the rest of the nation, faces significant challenges when it comes to elder care. Moreover, rising cost of care in this space is exacerbated by the fact that South Florida is an epicenter of Medicare fraud. While many institutions, like ours, operate according to the highest ethical standards, we are all affected by the prevalence of fraud. When the federal government does their audits, we are included.

Costs are also rising because people are living longer, a reality that we as a country have not fully prepared for. The fastest growing demographic in this country percentage wise is the 85 and up age group. The average age of a patient in our custodial living facility has increased by 10 years over the last 15 years. People are living longer and they are outspending their savings.

These costs are placing a burden on our nation’s health care system. The vast majority of health care spending takes place as individuals are closing in on the end of life—in the last year or so. Americans are accustomed to pursuing every course of treat- ment available, and as caretakers we often hear, “We want everything done.” Those extra steps may add a little bit of time, but does it add more quality to life? A long-term strategy to mitigate rising costs must involve setting and defining expectations for families and loved ones, as well as for the medical community.

The elderly care sector will continue to see growth, particularly in the areas of Alzheimer’s, dementia and cognitive disorders. As a response, we will start to see the creation of “memory care villages”—facilities for folks with cognitive disorders, staffed by caregivers specially trained to work with this class of patients, who can address their medical and mental health needs, and provide a quality of life that is familiar for them. At Miami Jewish Health Systems, we are evolving our care model to one that is solely patient-centered, for more enriched lives.

Invest: Miami speaks with Nabyl Charania, Co-Founder and CEO

The lack of professionalized or institutional investment has been an issue for this market and affects companies needing to access growth capital. A startup can raise the initial $200,000 to $2 million from angel investors, but getting to that next phase is more difficult. Recognizing these challenges, Rokk3r Labs launched Cross Valley Capital, a $20-million venture fund, to back emerging fund managers at Iterative Instinct, another $20-million early-stage fund. But it’s not just us: established funds like Accelerate Ventures, Scout Ventures and Mosley are realizing that a lot of good ideas are coming out of Miami.

South Florida has no shortage of wealth, but most investors do not know how to valuate tech investments. Many investors come here for the real estate, but once here, are open to other opportunities. However, unlike real estate, which is a tangible product, investors unfamiliar with tech need to be guided through the valuation of a tech investment. Everyone talks about exponential technologies and understands we are living in a special moment. The next step is to help a would-be investor understand the power of these technologies—to walk them through where we are and how far we have come in a few years.

South Florida has no shortage of wealth, but most investors do not know how to valuate tech investments. Many investors come here for the real estate, but once here, are open to other opportunities. However, unlike real estate, which is a tangible product, investors unfamiliar with tech need to be guided through the valuation of a tech investment. Everyone talks about exponential technologies and understands we are living in a special moment. The next step is to help a would-be investor understand the power of these technologies—to walk them through where we are and how far we have come in a few years.

Take drones. Eight years ago, you could not buy a drone. Six years ago, they were prohibitively expensive. Today, you can buy one for $30 and use it for your business. Communicating the potential of these technologies is crucial—someone may have made a lot of money on real estate, but where is the money to be made in the future? Opportunities lie at the intersection of exponential technologies. Seizing those opportunities requires, not just a certain knowledge base, but also a sense of imagination.

Building an ecosystem is a long-term project. We need support from public and private sector alike in innovation and entrepreneurship to develop the skillsets people need to become employable. We need to come up with a cohesive way for foundations, like the Knight Foundation, and government entities to become part of the framework as opposed to being the people you go to for money.

Invest: Miami speaks with Xavier Gonzalez, CEO

Miami is becoming the technology hub of the Americas, and eMerge Americas plays a critical role as the pre-eminent B2B technology event of the Americas. eMerge Americas was established three years ago to catalyze the development of a tech ecosystem and encourage connections between the world’s most important technology companies and top decision makers from Latin America. Building on the foundation of the investments we have attracted and the name recognition we’ve established in South Florida and Latin America, we are becoming the premier platform for the advancement of technology, a launchpad for innovation and an idea exchange.

Miami is becoming the technology hub of the Americas, and eMerge Americas plays a critical role as the pre-eminent B2B technology event of the Americas. eMerge Americas was established three years ago to catalyze the development of a tech ecosystem and encourage connections between the world’s most important technology companies and top decision makers from Latin America. Building on the foundation of the investments we have attracted and the name recognition we’ve established in South Florida and Latin America, we are becoming the premier platform for the advancement of technology, a launchpad for innovation and an idea exchange.

One of the drivers of our success is the summits under the eMerge umbrella. One of these is WIT (Women In Technology), inaugurated in 2015. Over 6,000 people attended the 2014 conference, 17 percent of whom were women. In 2015, we had over 10,000 attendees—over 33 percent women—and we attribute this increase to the success of WIT.

Another successful addition has been the eGov— Government Innovation Summit. eGov is crucial to world governments looking for ways to address issues affecting their constituents like transit. Meanwhile, the private sector, whether emerging startups or multinational corporations like Cisco, IBM and HP, is developing disruptive technologies and seeking to launch public-private partnerships. eGov brings these two groups together, allowing them to strategically connect.

The eMerge Americas Startup Showcase has featured the most innovative startup companies from Latin America, North America, Europe and Israel, with hundreds of investors connecting with the top entrepreneurs leading these companies. The connections between these innovators and strategic investors resulted in significant investments for many of the participants.

With partnerships with organizations like NBCUniversal, eMerge Americas has established itself as the Americas’ must-attend technology event. This success has helped Greater Miami and Latin America’s tech ecosystems grow slowly but surely.

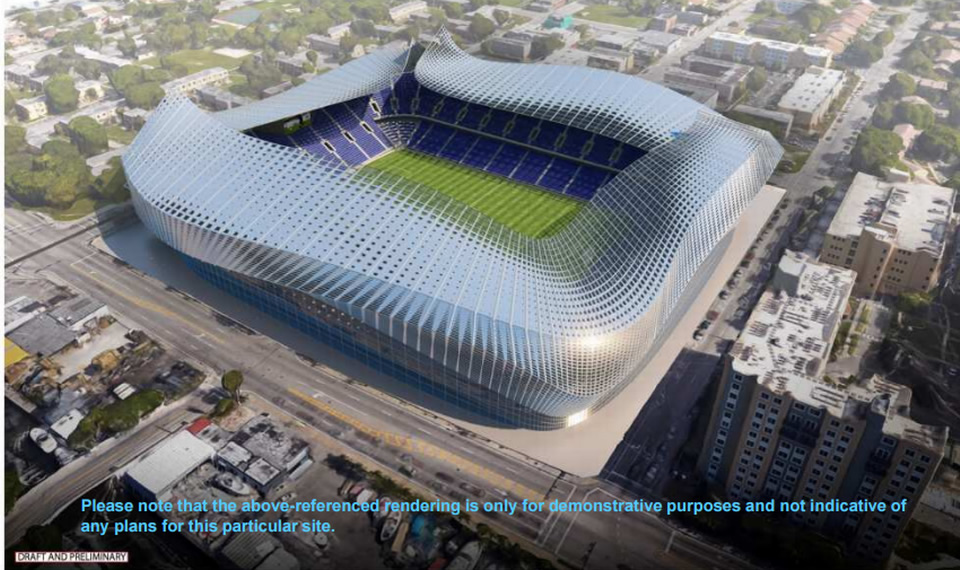

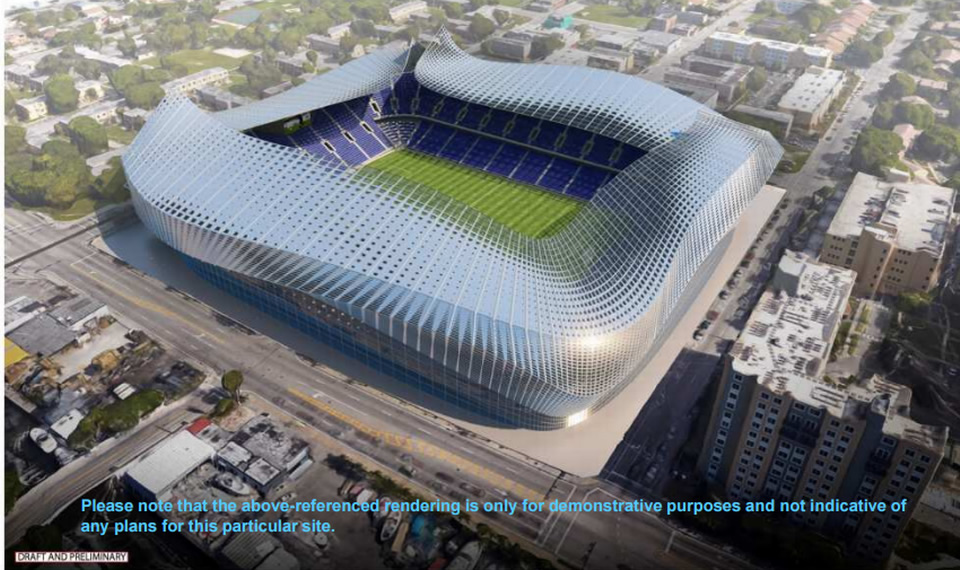

David Beckham and his investors have purchased the private land needed for a new stadium in Overtown, the organization announced Thursday, marking the first time the celebrity athlete has actually acquired Miami real estate for his Major League Soccer franchise.

The milestone gives the Beckham partnership ownership of about two-thirds of the nine-acre stadium site, according to the statement, and comes after more than two years of failed bids involving three other locations. The deals allow Beckham to now move fully into the political arena to win county approval for the purchase of government-owned land needed to complete the site for the stadium, and city approval of a zoning overhaul needed to build it.

“We have the right site, the right ownership group, and a loyal base of fans counting down the days until our first match,” Beckham partner Marcelo Claure, the CEO of Sprint, said in a statement. “We’re all-in on Overtown, and we couldn’t be more excited about moving forward with plans to deliver the most responsible stadium in Miami history.”

Miami Beckham United, the corporate entity Beckham owns with Claure, American Idol creator Simon Fuller, and others, has never made this much progress in its high-profile pursuit of a Miami stadium. Beckham wants a 25,000-seat home for the MLS expansion team he was given the option to purchase as a bonus for signing with the L.A. Galaxy soccer squad in 2007. Beckham’s option to purchase the franchise at a deep discount has been extended as his negotiators failed to land deals to build a stadium at PortMiami, next to the AmericanAirlines Arena in downtown Miami, and, most recently, across from Marlins Park in Little Havana.

The current site sits just north of the Miami River, in western Overtown and a short walk from the Spring Garden neighborhood. Bounded by Northwest Eighth Street to the north and Sixth Street to the south, the nine-acre property would be privately owned by the Beckham group, which began publicly chasing a Miami stadium in late 2013.

Beckham and partners are not asking for local subsidies to build or operate the stadium, and also say they plan to pay full property taxes for the land and venue. When the Marlins Park deal fell through in late 2015, Beckham declared Overtown his new top choice. The Dec. 4 announcement on Overtown included news that the partnership had, for the first time, signed sales contracts to purchase land for a stadium.

Actually buying the nine-acre property has taken longer than expected. Beckham and his ownership group hit delays in trying to close real estate deals for about six acres worth of privately-owned parcels surrounding an Overtown truck depot owned by the Miami-Dade Water and Sewer Department.

How banks are evolving to meet the needs of small businesses

Joe Atkinson South Florida Region President – Wells Fargo

How have the needs of South Florida small businesses evolved in recent years?

The studies we conducted in 2015 showed that small business owners are looking to make investments into their businesses, including owning their buildings. In addition, interest rates on five-year loans under the SBA 7(a) program have become fixed, so more small businesses are taking advantage of the program. As a result of these trends, small business owners are becoming more intentional about learning how to borrow money and manage credit. Wells Fargo is adding more bankers and opening new branches in Miami-Dade to respond to the needs of all of its customers, particularly in growth areas like Doral, as well as helping small business owners develop sound strategy, like building effective business plans through wellsfargoworks.com, a website designed for small business owners.

The studies we conducted in 2015 showed that small business owners are looking to make investments into their businesses, including owning their buildings. In addition, interest rates on five-year loans under the SBA 7(a) program have become fixed, so more small businesses are taking advantage of the program. As a result of these trends, small business owners are becoming more intentional about learning how to borrow money and manage credit. Wells Fargo is adding more bankers and opening new branches in Miami-Dade to respond to the needs of all of its customers, particularly in growth areas like Doral, as well as helping small business owners develop sound strategy, like building effective business plans through wellsfargoworks.com, a website designed for small business owners.

Miami-Dade is market dominated by small and medium enterprises (SMEs). What progress has been made to expand access to credit to these entities?

New models of lending are being created to suit the needs of SMEs. We have teams of experts who are familiar with the needs of particular industries and this understanding allows us to accept more types of borrowers. For example, we found that private medical practices need credit for certain types of medical equipment, which cost a certain amount. We subsequently created a lending model to help these practices based on our knowledge of their anticipated needs. We have also noticed that some SMEs are seeking to consolidate or acquire other businesses, and we are facilitating these needs as well.

One growing segment in Miami-Dade is tech startups. As with all startup businesses that are not traditional recipients of bank loans, banks still have a responsibility to help these businesses. Banks need to take an active role in serving startups by offering financial services, like facilitating cash flow and credit management.

What are some of the key challenges South Florida’s banking sector faces?

One challenge is addressing fraud, which, although is a global challenge, we see a high incidence of in Miami-Dade. Today, we are seeing more instances of click jacking, or the use of social media to mislead people into giving up their bank account information. In these schemes, people click on a link promising to deposit checks into their accounts and end up compromising their accounts. Banks have to pay close attention to how fraudsters are using technology and develop ways to counteract it, as well as invest in educating its customers of these dangers.

How operating in the middle space between big and small banks is a sound strategy

Jorge Gonzalez President & CEO – City National Bank

City National Bank was recently acquired by a large Chilean company. How does this event fit within other trends in South Florida’s banking sector?

What happened with City National is unique. Not many community banks in South Florida are foreign-owned. We will continue to  see a separation in the marketplace between the large banks and the smaller ones. Any organization that can fill that middle space, where you still have scale and technology, a good product offering and qualified bankers, but can conduct business in a small bank, “high-touch” way, is well-positioned. This is the niche that City National—which benefits from having a $40-billion parent company—occupies. From a broader standpoint, consolidation will continue to take place, in part because of the impact of regulations; in order to absorb the expenses related to providing proper oversight of a financial institution, you need more size. But the overall metrics in the industry—the costs of retaining talent and technology—also serve as contributing factors.

see a separation in the marketplace between the large banks and the smaller ones. Any organization that can fill that middle space, where you still have scale and technology, a good product offering and qualified bankers, but can conduct business in a small bank, “high-touch” way, is well-positioned. This is the niche that City National—which benefits from having a $40-billion parent company—occupies. From a broader standpoint, consolidation will continue to take place, in part because of the impact of regulations; in order to absorb the expenses related to providing proper oversight of a financial institution, you need more size. But the overall metrics in the industry—the costs of retaining talent and technology—also serve as contributing factors.

While consolidation is happening nationally, what developments set Greater Miami’s financial sector apart?

Miami is unique in that it has attracted capital from all over the world. One trend we are seeing is the entry of hedge funds and private equity firms in this market. This generates growth and brings greater liquidity to the marketplace, but also creates more competition. Much of the capital coming in, however, does not directly compete with traditional commercial banks. Non-banking financial institutions offer a different profile of investment than is needed in the marketplace. They complement what banks do and contribute to the maturation of this market.

What are some of the other indicators of the maturation of the South Florida market?

From a financial services standpoint, many banks here have already been through an economic cycle or two. These institutions have matured simply because they have been in existence and are seasoned, and the same can be said for local management teams. While Miami is relatively young compared to most major metro markets, this city has much more global visibility today than ever before. This means that even if we see a momentary pullback in values, either the capital is already here, or those who control it are already acquainted with this market and its offerings and will step in much sooner to deploy it. We are seeing capital coming from different markets— Europe, Asia, South America and even Mexico. It signals another stage of development when global investors feel there is enough opportunity and financial sophistication to warrant continued and large-scale investments. This is another indication of further development, progress and confidence in the overall marketplace.

How banking services are evolving to accommodate a more diversified market

Ernie Diaz Florida Regional President – TD Bank

What does it mean to be a Canadian bank operating in the Florida market?

TD Bank has seen tremendous growth throughout South Florida and it caters to the entire market, not simply internationals. We are seeing growth in all product lines, in particular commercial, small business, health sector and real estate lending, as well as our in-store distribution. The fact that there is such an influx of Canadians in this market gives TD Bank a competitive advantage, as the brand is familiar amongst that demographic, who have been active here for many years. While they initially flocked to South Florida because of the favorable climate and quality of life, they are now seeing this market as advantageous for conducting business.

How have regulations impacted the local banking sector?

Banks have been greatly affected by the current regulatory environment, especially in the realm of international transactions. Regulations have particularly impacted the way we finance foreign trade. This means that Small Business Administration (SBA) loans and export-import programs become even more critical, especially for a market like Miami that relies so heavily on trade. What we are seeing is that as traditional financing options have stalled, private equity and finance firms are filling the gap in financing some of this trade.

What have been the drivers of growth for commercial lending in the past year?

Florida has become an increasingly important market within the U.S. The state’s population growth has outpaced New York’s. The state has seen healthy growth in manufacturing, wholesaling and services, as well as the number of startups. In South Florida, we are seeing high volumes of foreign investment. Real estate has rebounded. We are seeing more capital expenditures. Companies are starting to come back into the black.

As a banking executive and the incoming chair of The Beacon Council, how do you view the development of Greater Miami’s business community?

This is an exciting time in Miami-Dade’s development. There are high concentrations of financial and human capital. This factor, in addition to the fact that there are relatively low barriers to entry in this market, creates an inviting environment for new immigrants and businesses. We’ve proven we can recruit talent to this market—the question is how do we retain this talent. The Beacon Council has been actively cultivating mentorships and linking educational institutions and the private sector. These efforts are building a foundation for long-term growth.

With 5 million visitors coming to Miami Beach annually, the importance of Mount Sinai Medical Center and its strong emergency department cannot be overstated. Moreover, the economic impact that Mount Sinai has on its surrounding community is tremendous, falling somewhere between $5 billion and $6 billion a year. We are the only hospital in this city, and with 3,700 employees, we are also the largest employer in Miami Beach.

With 5 million visitors coming to Miami Beach annually, the importance of Mount Sinai Medical Center and its strong emergency department cannot be overstated. Moreover, the economic impact that Mount Sinai has on its surrounding community is tremendous, falling somewhere between $5 billion and $6 billion a year. We are the only hospital in this city, and with 3,700 employees, we are also the largest employer in Miami Beach. When people think of Miami-Dade, they tend to focus on the glitz and the glamour. But this community, like much of the rest of the nation, faces significant challenges when it comes to elder care. Moreover, rising cost of care in this space is exacerbated by the fact that South Florida is an epicenter of Medicare fraud. While many institutions, like ours, operate according to the highest ethical standards, we are all affected by the prevalence of fraud. When the federal government does their audits, we are included.

When people think of Miami-Dade, they tend to focus on the glitz and the glamour. But this community, like much of the rest of the nation, faces significant challenges when it comes to elder care. Moreover, rising cost of care in this space is exacerbated by the fact that South Florida is an epicenter of Medicare fraud. While many institutions, like ours, operate according to the highest ethical standards, we are all affected by the prevalence of fraud. When the federal government does their audits, we are included.

Miami is becoming the technology hub of the Americas, and eMerge Americas plays a critical role as the pre-eminent B2B technology event of the Americas. eMerge Americas was established three years ago to catalyze the development of a tech ecosystem and encourage connections between the world’s most important technology companies and top decision makers from Latin America. Building on the foundation of the investments we have attracted and the name recognition we’ve established in South Florida and Latin America, we are becoming the premier platform for the advancement of technology, a launchpad for innovation and an idea exchange.

Miami is becoming the technology hub of the Americas, and eMerge Americas plays a critical role as the pre-eminent B2B technology event of the Americas. eMerge Americas was established three years ago to catalyze the development of a tech ecosystem and encourage connections between the world’s most important technology companies and top decision makers from Latin America. Building on the foundation of the investments we have attracted and the name recognition we’ve established in South Florida and Latin America, we are becoming the premier platform for the advancement of technology, a launchpad for innovation and an idea exchange.

The studies we conducted in 2015 showed that small business owners are looking to make investments into their businesses, including owning their buildings. In addition, interest rates on five-year loans under the SBA 7(a) program have become fixed, so more small businesses are taking advantage of the program. As a result of these trends, small business owners are becoming more intentional about learning how to borrow money and manage credit. Wells Fargo is adding more bankers and opening new branches in Miami-Dade to respond to the needs of all of its customers, particularly in growth areas like Doral, as well as helping small business owners develop sound strategy, like building effective business plans through wellsfargoworks.com, a website designed for small business owners.

The studies we conducted in 2015 showed that small business owners are looking to make investments into their businesses, including owning their buildings. In addition, interest rates on five-year loans under the SBA 7(a) program have become fixed, so more small businesses are taking advantage of the program. As a result of these trends, small business owners are becoming more intentional about learning how to borrow money and manage credit. Wells Fargo is adding more bankers and opening new branches in Miami-Dade to respond to the needs of all of its customers, particularly in growth areas like Doral, as well as helping small business owners develop sound strategy, like building effective business plans through wellsfargoworks.com, a website designed for small business owners. see a separation in the marketplace between the large banks and the smaller ones. Any organization that can fill that middle space, where you still have scale and technology, a good product offering and qualified bankers, but can conduct business in a small bank, “high-touch” way, is well-positioned. This is the niche that City National—which benefits from having a $40-billion parent company—occupies. From a broader standpoint, consolidation will continue to take place, in part because of the impact of regulations; in order to absorb the expenses related to providing proper oversight of a financial institution, you need more size. But the overall metrics in the industry—the costs of retaining talent and technology—also serve as contributing factors.

see a separation in the marketplace between the large banks and the smaller ones. Any organization that can fill that middle space, where you still have scale and technology, a good product offering and qualified bankers, but can conduct business in a small bank, “high-touch” way, is well-positioned. This is the niche that City National—which benefits from having a $40-billion parent company—occupies. From a broader standpoint, consolidation will continue to take place, in part because of the impact of regulations; in order to absorb the expenses related to providing proper oversight of a financial institution, you need more size. But the overall metrics in the industry—the costs of retaining talent and technology—also serve as contributing factors.